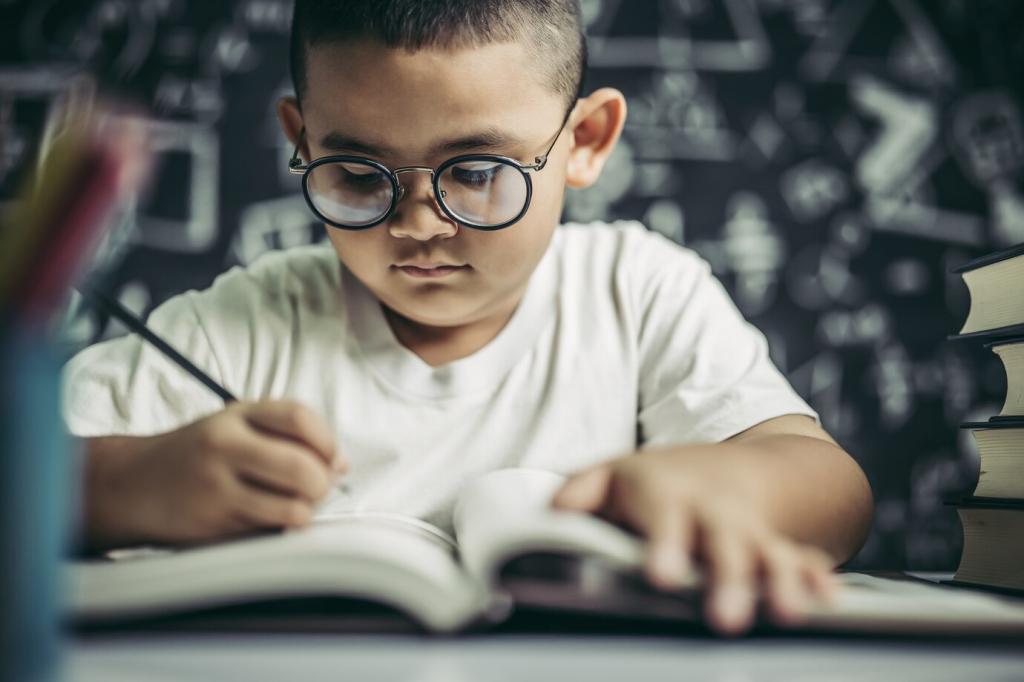

Measuring Risk You Can See and Explain

Volatility suggests how widely returns bounce around their average. Bigger swings mean more uncertainty in outcomes. If the ride feels rough, your position may be too large. Subscribe for our monthly plain‑English metric breakdowns.

Measuring Risk You Can See and Explain

A drawdown tracks peak‑to‑trough loss. It tests nerves more than spreadsheets. Many investors bail near the bottom, turning temporary pain into permanent loss. Have you ever sold too soon? Share the lesson so others learn.

Measuring Risk You Can See and Explain

Assets that move differently reduce portfolio shock. Correlation shows how synchronized they are; beta shows sensitivity to the market. Blending low‑correlated pieces can smooth returns. Tell us which diversifiers worked for you this year.